How can you invest $1000 and use it as a springboard to build wealth?

There are variety of ways to do this and I’ll share the absolute best strategies and options in this post.

Maybe you’ve saved a little and want to know the best way to use it to get the most on your investment or the greatest R.O.I. (Return on Investment).

The good news is, if you can save up a grand, you can absolutely start building wealth!

Here are the steps you can take to build wealth with the little you saved up in order to give you the lifestyle you want.

It won’t be easy but it can be done.

Section 1: Build Wealth by

Setting Yourself Up for Success

You may be tempted to skip over section one and just go to Section 2 which covers some specific ways to build wealth.

This would be a mistake.

The items in section one are the foundation on which you would build your empire.

If you have a weak or compromised foundation, all the wealth you create could come crashing down and leave you destitute.

That being said, let’s get started.

1) Make Sure you Have the Right Wealth Building Mindset

Before you take any action you need to examine your mindset.

This is one of the largest indicators of success in any endeavor.

Losing weight, as usual, is the perfect analogy.

The basic recipe of losing weight is very simple.

Most people can tell you what they would need to do in order to drop a few pounds.

The reason most people aren’t successful though is that they don’t have the right mindset.

They carry around extra mental baggage and beliefs that hold them back such as “my body is just built this way”, “my metabolism is too slow”, “I’ll never keep it off” or “I can’t lose it”.

With these beliefs in place, it’s hard to stick to a healthy lifestyle and diet because at the deepest emotional level, they believe they will eventually fail anyway.

The same is true of making money and holding on to wealth.

If you believe it takes money to make money or the rich just get richer or even that your upbringing negatively affects your chances of success, then you will never really commit yourself to the work and self-discipline needed to build a financial future others will envy.

Thomas Edison said “Opportunity is missed by most people because it comes dressed in overalls and looks like work”.

Opportunity is missed by most people because it comes dressed in overalls and looks like work. (Thomas Edison) Click To TweetThat’s a pretty good analysis.

The best way I’ve found to keep my mindset right is to listen to podcasts, watch inspiring YouTube & how to videos, read books on successful principles and people, and also watch inspiring television.

There’s a lot of negativity around watching television.

Some people say you shouldn’t watch TV if you’re trying to be successful at something and that the time is better spent building your empire.

There is some truth to that, but the other truth nobody talks about is that we are all people and like to be entertained.

People do watch TV for entertainment (myself included).

But I try to limit my television time to shows that motivate, inspire, or teach me something.

Some of those include house flipping shows like Flip this House, biography and historical shows on great business people or businesses, Shark Tank, and even Undercover Boss.

I like Undercover Boss because you get to see that even top CEO’s are just people.

They are moved by others situations and they want to make a difference.

2) Build Wealth by Setting Goals:

Start With The End in Mind

Taking your money and putting it into an investment doesn’t do any good if you haven’t decided what your goals are.

Do you want to make big chunks of cash to pay off debt and reinvest or is your focus on building positive cash flow?

You’ll want to decide on these things in advance before moving forward because the strategies you use will be completely different.

If you want to replace your income as quickly as possible, something with a monthly cash flow is probably your best bet.

If you want to pay off debt or buy a new toy, that’s probably not the most efficient way.

One exception to this would be if you were going to finance your toy.

I’m not a fan of debt and I think it should be eradicated from your finances.

But there is another school of thought out there that believes in good debt and bad debt.

If you really want something and you’re asking the right question, which is “how can I afford this”, your question may lead you to a creative solution that includes using good debt to finance bad debt.

What do I mean by that?

Let’s suppose you want to get a new boat.

I have no idea the price for boats these days but let’s just say the payment is $600 a month (It’s a nice boat).

Rather than getting traditional financing and using your work related income to finance it, you could create passive income with investments that generate $600 a month.

Then your passive income would be paying for your new toy.

This would work for a pool, a new car, or anything with a payment.

The beauty of it is that it can be a little more motivating to think about creating $600 extra a month than to try to save up $40-50K dollars to buy something.

This is because of the mindset issue and it’s a mindset hack that can work until your confidence grows enough for you to believe you can build up large sums for large purchases.

The lower number makes your brain think it’s more possible (which isn’t really true), which leads you taking action, which will lead to success.

It’s a self-fulfilling prophecy and it’s the first principle to master in learning how to build wealth.

3) Spend Time Every Day Learning

Don’t dismiss this important element of success.

However you decide to build wealth, you need to spend time every day learning about the path you have chosen.

I’ll discuss some wealth building strategies that you can start on a shoestring budget in the next section, but you need to acknowledge that learning shouldn’t end with school.

Learning should be something you do every day.

Learning can take many forms.

A lunch with a friend who is further down the road than you, a good book, a seminar or online course (do extensive research and due diligence before purchasing these, there are a lot of charlatans out there), podcasts, or even a website with free resources.

Google and Youtube are excellent sources of learning and you can find information on any topic.

That’s how you got here, right?

There’s nothing you can’t learn if you have an internet connection, a will to learn, and a devise to connect with.

4) Develop a Strong Work Ethic

Dreamers are a dime a dozen.

Doers rule the world.

Said another way…

Dream believers are in abundance. Dream buyers are rare. (John Maxwell) Click To TweetYou’ve got to be determined to work harder at building wealth than you’ve ever worked for a 9 to 5 job.

The only one who suffers if you don’t is you.

I made that mistake once.

There was a time when I left my job for the easy money of the mortgage industry.

I was originating loans on the side and making more money than I was in my full time job.

It was completely systematized from the leads to the paperwork.

All I did was study and get a license and then basically show up at the closing table and get paid.

I was making more money than I did in my full time job with only a few hours of work a month.

So I left my job and started a firm with a partner.

I still remember the call telling me that everything just “dried up” and ended.

I was literally on the floor hand laying tile in our new office when the call came in. I felt like I just got punched in the stomach… hard.

The next thing I knew I was in insurance sales which I loathed.

The part I didn’t like about insurance sales was sales.

I got nervous and had butterflies every time I picked up the phone or knocked on a door. Plus, it was during the 2008-2009 economic recession and insurance wasn’t an expense people were throwing money at.

After a year of marginal commissions I went back to doing what I used to do, education.

I got my salary back and before too long I was out of the classroom and a dean of discipline.

Guess what I learned?

I was now doing the same basic job as insurance sales but worse.

I guess my fear in insurance sales was that somebody would be angry or rude or yell and curse at me on the phone.

I’m not really sure what I was scared of but since it was commission only, I would sit around and find a thousand things to do other than calling on potential clients.

With a full time job, I didn’t have that luxury.

I had to make the calls because it was my job. In fact, as a discipline dean at a large, understaffed, and rough middle school, I was making 10 times the calls I made in the insurance industry.

The difference was I was no longer guessing whether the person on the other side of the phone would be angry or not.

They 99% of the time they were.

When you’re calling to suspend a child or tell a parent what discipline their child is receiving for their actions, you will be met with anger and frustration almost every time.

As a parent, I will never understand that because if my child’s school calls, my kids got some explaining to do.

If you feel the same way, consider this.

Your kid probably knows that and you probably rarely get calls.

You’d think it would be directed at their child for making a bad choice but usually it was directed at me because somehow it was my fault.

Eventually (and this is important), I grew desensitized to people yelling and cursing at me on the phone.

I realized that if I had made the same number of calls in insurance, I would forced my own desensitization but the difference is I’d be making much more money.

So learned from my mistake. Be hard on yourself so the world doesn’t have to and so you aren’t limiting you success.

Successful people do what unsuccessful people are unwilling to do (Jim Rohn). Click To Tweet5) Build Wealth by Starting Small and Reinvesting your Profits

This is where the action steps begin or as they say, the rubber meets the road.

Let’s do a quick recap…

1) You’ve gotten your mindset right.

2) You’ve set your goals based on the end result you want to get.

3) You’re committed to having a strong work ethic.

Now it’s time to start taking action.

If you’ve landed on this page, you probably have or will soon have a little start-up capital.

A good goal is about $1,000 or more.

This is a great beginning point.

I’m going to go over some potential businesses you could get off the ground with a thousand bucks.

All of these will require the three things I’ve stated above.

Once you pick a strategy though, the key to building massive wealth and income is compounding.

You may have heard of compound interest.

I’m not talking about interest, but I am talking about the same basic compounding principles.

I call it compound profits and to me it’s more powerful than compound interest.

Interest rates are lower than they used to be. This is great if you’re getting a loan, but no so good if you want to invest your money.

The days of putting your money in a traditional investment, sitting back and watching it double over time is long gone.

But you can watch it compound extremely quickly if you are willing to put in some of your own sweat equity and hard work.

The difficult part is having enough self control to not pull your money out to spend when it starts to be a significant amount.

You’ll need to be disciplined if you want the compounding effect to work for you.

Here’s my top tips of how to build wealth on a budget.

Section 2: Best Businesses

To Start for $1000 or Less

Idea 1: Start a Niche Blog

Cost: $150-$300

Blogging can lead to significant profits.

It takes time to build traffic and you must be able to write or find somebody who can.

But once the traffic is in place there are numerous ways to monetize the website.

I’ve even heard of people selling their blogs for large cash sums as an exit strategy.

The reason this is a great way to build wealth on a budget is because it leaves some money on the table if you’re starting with say… $1,000.

It won’t take the full thousand.

The only investment you’ll have is the time and work you put in plus the cost of the domain name, hosting, and a premium theme if you’re using wordpress.

We’re talking $200-$300 to launch and the monthly cost of hosting.

You could probably pay for your entire year and launch for less than $500.

I highly recommend using wordpress, picking a theme for speed, and using bigscoots for hosting.

There are numerous reasons for these recommendations, but just have some faith in my experience and save yourself hassle and money in the long run.

If you have a little extra cash for your initial investment, my brother has a program you can get that will walk you step by step through how to get your blog up and running, from start to finish.

If you go with the blogging route, pick a blog topic that you’re interested in and that there is potential money in.

You don’t want to start too broad or you’ll quickly learn that ranking on Google is not as easy as you think.

Common sense is in order here.

You can do all kinds of research but at the end of the day you know if it’s something you’re interested in and wouldn’t mind researching and writing about.

Hopefully you know or can guess if there’s a market for it.

If not, you can research this online.

Just do a little homework on Google to find out what you can.

Another reason this is a great way to invest your money is because over time you can grow your blogging income.

It’s not quite passive because you have to work at it consistently.

But as long as you aren’t doing shady things with your blog like stuffing keywords or buying links, you should be able to grow an income stream from it fairly steadily.

It’s also very low risk if you’re financially risk averse.

Let’s say you spend $500.

The time and energy you’ll put into to learning how to build a website using WordPress will buy you some time to save even more money.

Plus, it’s a marketable skill all by itself.

You could charge others to set up their websites.

You should be able to continue to add to your savings a little here and there so just in case your blog isn’t as successful as you expected or you decide it’s not for you, you’ll probably be back at $1,000 for your next investment.

Since you won’t have lost everything, you won’t be mentally frustrated and you’ll have learned a lot of useful skills for your next venture.

Of course, if you do it well, you may not need a next venture and going in with the option of quitting later is not a good strategy for creating success in anything.

Idea #2: Start a Local Directory Website.

Cost: $300-$500

This is one thing I’m working on right now for my community.

It’s going to cost you a little more because you’ll need to get a quality WordPress theme that is specifically designed for directories.

The one I use is Vantage and I really like it even though it’s a bit cumbersome on the back end.

It’s basic, easy to use, and has a pretty good look to it.

It’s not flashy, but so far it’s performing well.

It’s also got some ad spaces you could sell in addition to the regular listings.

It’s more labor intensive than just blogging because you must manage events, manage directory listings, and also manage a blog since it’s got a blog built in.

I’ve decided to go with this as one of my side gigs because the potential for revenue is a bit better as well.

The possibility of ranking for your local city in search terms brings your competition down because you’re not competing with the entire world.

In addition, listings and events help pull in web traffic even though they’re also a potential revenue source.

Once the web traffic is rolling in, you can put on your sales hat and talk to local businesses.

You’d be surprised how many of them are paying big money for sites like Yelp and others.

I talked with a business owner today who was paying Yelp $70 just to “hold his spot” because he couldn’t afford the $200+ dollars they wanted every month. His listing isn’t even active and he’s paying them $70 per month.

By focusing on one city and positioning yourself as a local fellow business owner, you should be able to pick up enough clients to get a good income stream going.

I would caution you to get some traffic first before asking people to pay though.

You can also trade listings with local businesses.

I got about $300 worth of carpet cleaning done recently by trading. I gave a listing and the carpet cleaner gave me the job for free.

It was a straight trade.

He wins and I win, and since no money changed hands, we don’t have to pay taxes on the transaction.

A beautiful win-win situation. (Disclaimer: talk to your tax specialist before believing anything I say).

Having a site like this can be worth just the trades if you do them a lot.

It took the carpet cleaner hours of time and the cost of the cleaning supplies to clean my house.

It cost me nothing to give him a listing and I spent about 10 min. putting it on the site.

With a listing site, the cost is fixed once you’re up and running.

If you need 1-2 clients to break even, every one after that is gravy.

Idea #3: Flip some vacant land.

Cost: $1,000+

This one costs a little more than $1000 in the beginning because you have to find the deal first and that takes marketing.

This idea is also geared less toward an income stream and more toward creating chunks of cash.

But it can be highly lucrative and profitable.

I’m currently engaged in all three of the above business activities and the land business makes the most money quickly with the least amount of effort.

The premise is that you create a mailing list using public records and mail people a good old fashioned snail-mail letter stating you are interested in purchasing their land.

Then, using sites like Zillow, you make an offer that would allow you to make a profit.

The key to success in this is buying the land at the right price and in an area where people are purchasing land.

If you can’t find a buyer in the marketplace you’re the sucker in the transaction, regardless of how cheap you get the land for.

To read a more in depth analysis of this strategy check out the Best methods for doubling $1000 fast., it has a very in depth look at this particular strategy.

Note: It’s strategy number 4 or 5, so you’ll need to scroll down the page to see it.

Idea #4: Build Wealth with a Consulting or Coaching Business

Cost: $300-$1,000

In the journey of life, we are all on the same road but at different places.

You may not believe it, but you have some life experiences and knowledge that you could use as a basis for consulting or coaching.

If you don’t believe me then go back and read the section on having the right mindset.

The cost of a consulting business will again be the price of a website/blog, some business cards, and some marketing materials.

Decide ahead of time how much you are going to spend.

Starting a consulting business could easily cost a lot.

Cap your spending in the beginning, get the essentials, and focus on being profitable.

If you do that, this is a great way to build wealth on a budget.

I always try to spend a small amount first, just to see if my idea has any teeth before I invest additional money.

The majority of small businesses in America fail in the first few years and I believe it’s because people spend money they don’t need to spend because it feels productive.

You know what else is productive… picking up the phone and cold calling (not fun, but it’s free!).

It also feels like the easiest route to sales. If I just throw enough money at it… it will pan out.

Not necessarily.

Consulting is typically centered on business or industry.

Perhaps you have some experience in marketing, sales, writing, construction, plumbing, etc.

Sit down and make a list of things that you are good at then think about what kind of services you could offer as a consultant.

Some consultants even do phone consulting in which clients pay them by the minute.

With Covid-19 driving people indoors, I think more and more consultants will be using video chats like zoom for consulting because so many more people will be comfortable with connecting digitally.

Anyway, consulting is a good strategy if you’re an encyclopedia of knowledge on something. People are willing to pay good money when they run into an issue they need answers for immediately.

They want an answer right then and they’re willing to pay for it.

Coaching is a little different from consulting but it’s the same premise.

You’re being paid to help make something better but it’s usually centered on personal life.

Business coaching is a buzzword, but to me it’s just a different word for consulting.

When you think of coaching, think of typical problems that people struggle with that you may have experience with.

Overcoming addiction, marriage and family issues, raising kids, managing finances, losing weight, and dealing with adversity or unexpected changes would be potential ideas for coaching.

If you really want to do something rewarding while investing your money, this has the potential for you to be a part of changing somebody’s life dramatically.

This is where your life experiences will have more value than you may think.

If you’re a fully recovered addict, do you think there are families out there struggling with addiction in their family and looking for solutions?

You bet there are!

Idea #5: Build Wealth with Speaking and Teaching

Cost: $300-$1000

Speaking is another business that can pay you good returns.

Just like coaching and consulting, it is important to cap your spending in the beginning.

You don’t need a fancy office and thousands of dollars’ worth of “how to” information.

Start small and grow it from there.

If there’s a program about building a speaking career that you really want, force yourself to make enough through speaking to buy it.

That will help motivate you and when you get to the point you can purchase it entirely with profits you may find that you don’t need it anyway.

However, at the same time, a quality program can shave months or years off the learning curve.

This article was written with the neophyte business owner in mind who has very little capital.

If you have some money to invest and some speaking experience, a quality program could potentially be worth the investment.

It’s hard to put a monetary value on speed, especially if you want to build wealth fast.

Maybe you figure it out by yourself and it takes you five years to get to the income you want.

What if the right program gets you there in a year?

What if you never figure it out yourself?

Just something to think about.

With a speaking business it will be critically important to learn about sales and how to market yourself well.

You’ll probably want to create a YouTube channel and maybe even do some free speaking engagements where you can video tape yourself to show people what they’ll get.

Final Thoughts on

How to Build Wealth on a Budget

Now that you have some ideas for businesses you can start with $1000 dollars, it’s important to take action every day.

Do something for your business and investment, even if it’s just research and learning, that moves you forward in the right direction.

Remember too, that whatever you choose to do, I strongly believe a blog or website can be a strategic component of your strategy.

It’s just not feasible to show up in people’s searches without providing valuable text and/or video content (known as vlogging), so make it a big part of your plan.

I think it was Warren Buffet who said the key to investing is to never lose money.

That should be your goal.

Never lose money!

If you only invest what you need upfront to get started, there’s no reason you shouldn’t be able to make your money back fairly quickly.

In addition to that, the returns on your money will be astronomical.

I’ve bought land for less than $900 (total price) and sold it for $5000 a few months later using the land strategies I talked about.

That’s more than a 500 percent return in just a few months!

The answer to the question “How to build wealth” is going to be different from person to person depending on their situation and starting capital.

The most important thing is to pick something that makes sense to you and start taking action.

Please share this post on your favorite social media platform.

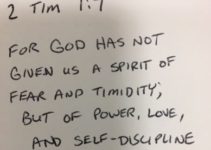

Lastly, the wealth of this world pales in comparison to a personal relationship with Jesus Christ.

If you’d like to start a relationship with Jesus, please head over to our page about that topic.

Jason & Daniele