The Cashflow Quadrant by Robert Kiyosaki is packed full of great ideas.

It gets less attention than his book Rich Dad, Poor Dad, but I’m not sure why because it’s better.

Cashflow Quadrant has more substance and changed my thinking on financial freedom more than any other of Kiyosaki’s books and I think it’s the best book in the Rich Dad Series.

Maybe you don’t have time to read the whole book, but you want to understand some of the basic ideas so you can implement them in your life.

In this post, I’ll give you a summary and overview of the book.

Maybe you already read it or maybe you just need a refresher.

Either way, here we go.

Cashflow Quadrant Explained

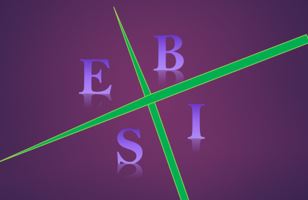

The premise of the Cashflow Quadrant is that there are four main ways of earning income.

This can be represented in a visual of four different quadrants (above).

Kiyosaki’s cashflow quadrant is meant to teach you the fundamentals of how money works and how the rich leverage different quadrants to grow wealth.

The quadrants are simply different methods for earning income.

You can earn income from one, two, three, or all four of the quadrants.

The 4 Cashflow Quadrants Explained

To get us started, below is an overview of each of the specific cashflow quadrants as explained in Kiyosaki’s book.

(E) Employee Quadrant

This means your income comes primarily from a job.

You can still be a high earner in this category.

Think of a hired CEO or president of a company.

Some CEO’s make tens of millions of dollars, but they are still trading time for dollars.

It’s still considered active income.

Active income meaning, if you stop working, you stop getting paid.

(S) Self-Employed Quadrant

This is when you own a job.

You may own a small business, but the income stops if you stop working.

Many small business owners fall into this category.

Perhaps they bought into a franchise or built up their business with themselves as the primary earner.

Either way, the majority of the income generated in this category is from the owner/operator actually working.

That’s why Kiyosaki states that you own a job (because the job owns you).

I have a friend who has his own contracting business.

He hasn’t taken vacation in 10 years because the business will not and cannot operate without him.

That’s not freedom, but it is what it is.

Financial freedom is something very different.

Often people start a small business so they are “in charge” and can control their time.

But it often requires they let the business dictate their time.

(B) Business Owner Quadrant

You own a system and people work for you.

The business owner quadrant is different from the self-employed quadrant because the income and business isn’t directly tied to the business owner.

In this quadrant, the owner has set up systems and people to leverage their own time.

Kiyosaki states that you can tell if you’re in the quadrant of a true business owner (B) and not just self-employed (S) by taking an audit of what would happen if you left your business for a year or more.

Those operating a true business (B), can leave their business for a year and when they return their business will potentially be running better and more profitably than before they left.

They are completely outside of the business and it operates without them (often even better than when they are there).

(I) Investor Quadrant

Your money works for you.

These can be investments in stocks, bonds, real estate, or any number of investments that offer a monthly residual income.

This could also include trademarks, royalties, and copyrights.

I always think of the shark tank when I think of the investor category.

Every time Mr. Wonderful (Kevin O’Leary) offers somebody a royalty in perpetuity (meaning they get paid a royalty for each sale… forever) and they turn it down… I cringe.

Just to give you an idea of how powerful royalties can be, check out this quick video on the guy that created and owned the patent for super-soaker water guns.

All Four Cashflow Quadrants have Rich and Poor People

Kiyosaki mentions that none of the quadrants guarantee financial freedom and success.

People earn millions in all of the quadrants and people go bankrupt in all of the quadrants.

They are just different methods of generating income.

By understanding these differences you can better figure out which quadrant will work best for you.

However, I would argue that Kiyosaki makes a strong argument throughout the entire book that the right side of the cashflow quadrant model is the side you should aspire to operate in.

It is the most powerful and most leveraged side with the most income potential.

Left Side of Cashflow Quadrant: Active Income

The left side of the cashflow quadrant is what is considered active income.

This means for the income to come in, you must be active.

You are earning wages, salary, or commissions.

When you stop working or performing, your income stops.

Those earning income on the right side of the cashflow quadrant focus on getting a good job and earning a good salary.

They are working for security (even though it’s not really secure).

90% of the poor and middle class earn all of their income from active income on the left side of the cashflow quadrant.

Right Side of Cashflow Quadrant: Passive Income

The right side of the quadrant is considered passive income generation.

This is when you are no longer trading time for dollars.

You have leveraged systems or investments to keep the income stable even if you are not actively involved with the business or investment.

Cashflow Quadrant Video

Here’s an overview of the quadrant in Robert Kiyosaki’s own words:

The Compounding Effect

Some quadrants (those on the right side of the quadrant) have a compounding effect.

They can grow exponentially over time, while the quadrants on the left side are more static.

For example, an employee can only make so much per hour.

They can change jobs, make more per hour, or work more hours to earn more, but they are still trading time for dollars.

A self employed worker (also earning active income) will run into the same problem.

They have limited time to trade for dollars.

However, the work of a business owner or investor has the possibility of exponential growth.

The business or investment can get traction over time and start to grow at a phenomenal rate pushing earnings through the roof (without requiring more time from the owner/investor).

In Rich Dad, Poor Dad, Robert Kiyosaki explored this idea a little when he talked about how his poor dad earned a higher salary than this rich dad for most of his life.

However, there was a point of exponential growth for the investments and businesses that Kiyosaki’s rich dad spent time on.

His rich dad’s income then overtook and dwarfed his poor dad’s income quickly when that happened.

That’s the compound effect in action.

How the Cashflow Quadrant Defines

Wealth and Types of Investments

In the book, Kiyosaki also explains the difference between being being rich and being wealthy.

The differences comes down to the income and liabilities you are carrying.

If your income is substantially more than your liabilities, then you are wealthy (i.e. financially free).

You can be rich (large income and lots of toys) and still not be wealthy (financially free).

It is in this section that Kiyosaki discusses how most people spend as much as they make, regardless of the size of the income.

This makes it difficult to invest because you can’t invest money that you don’t have.

He also discusses other forms of investing such as traditional education.

Why More People Don’t Invest and Managing Risk

The reason most people don’t move to the right side of the cashflow quadrant comes down to fear of loss.

There is risk and potential in any business or investment.

It’s this fear that holds people back.

Kiyosaki makes the point that the world is changing.

People are living longer, thus pension funds and traditional retirement is changing.

The well is drying up.

Companies are cutting back.

Retirement is starting to fall on the individual and the families of the individual.

Can you imagine running out of money when you’re 85 years old?

What are your options at that point if you want to start earning again?

How hard would it be to get a job (if you’re even capable of working).

As technology changes, low wage jobs are disappearing and being replaced with computers and smart technology.

Here’s an interesting video on this topic and something you need to really think long and hard about.

I would argue that not trying to transition to the right side of the quadrant is probably the most financially risky thing you can do (or fail to do).

Low Risk Way to Move to the Business Owner Quadrant

If you’re currently earning on the left side of the cashflow quadrant and are ready to move to the right side, the best way to do it is to start a home based business.

A real business that falls in line with that B Quadrant, not a traditional self-employed situation.

There are many benefits to this type of business.

For example, you can begin to leverage systems to create passive income and also take advantage of a business model that has exponential growth built in.

I encourage you to take a look at the business model with an open mind.

The world is changing, the perception of this model is changing, and you should be willing to pivot if you want to thrive financially.

We are changing lives (financially, spiritually, and physically) and we’d love for you to be a part of it.

If you’re ready to take action and start working on replacing your active income with passive income, then I encourage you to take a look.

Come dream with us.

Grow with us.

Travel the world with us.

Learn More about Working With Us

In the words of Zig Ziglar, We’ll “see you at the top”.

To conclude, we like to end each post by inviting you to start a personal relationship with Jesus Christ.

It is the most important decision you will ever make.

Jason & Daniele