Income Inequality & Wealth Distribution in America

The REAL truth about the top 1%

Wealth is defined as the total net worth of an individual, effectively the number of assets minus the number of liabilities that a family or an individual has.

- Assets include cash held in savings accounts, real estate, retirement accounts, homes that one owns, as well as investments in things like stocks.

- Liabilities include mortgages, credit card balances, car loans, student loans, and any other unpaid bills.

Wealth inequality in America is not a new issue but it seems to be a growing epidemic.

America’s wealth inequality and distribution is spurred on by a continuous vicious cycle of the system.

It’s so pronounced that it contributes to many subsequent problems such as an unequal amount of wealth concentration, wide income gaps in household wealth, home ownership, and racial divides.

Much of this site is centered around trying to equalize this by giving people of all walks of life access to the knowledge, mindset, and tools to fight their way out of this system- if they choose to.

America's wealth inequality and distribution is spurred on by a continuous vicious cycle of the system. Share on XWhile there are no easy answers to this growing issue, understanding it is the first step to moving toward solutions.

You May Also Enjoy:

– How to Build Wealth with $1,000

– 7 SECRET Hacks to Building Wealth Fast

Mindset is a Major Contributor to the Income Inequality Gap

Wealth inequality in America continues to worsen as the income gap between the majority of Americans and the richest of Americans widens, a trend that has continued by every statistical measure for over three decades.

That’s 30+ years of a problem continuing to grow.

The causes of extreme gaps in wealth distribution in America is traced primarily to income inequality.

Income is often thought of as the money brought in from a job each month because for most Americans, that is the only source of income they have.

But for the richest Americans, income is defined by revenue.

This can be revenue from regular wages, corporate salaries, interest gained on savings accounts, profits from investments (particularly stock portfolios), real estate investments, and other income streams.

Unfortunately, the mindset and beliefs necessary to create these other sources of income is not taught in school. Since it is a mindset and belief structure, a parent without the knowledge cannot pass the knowledge on to their child.

Those in the top 1% teach these concepts to their children, so generation after generation, the wealth of a family grows while those without wealth seem stuck.

Related Wealth Articles:

-Money Tree vs. Income Stream

– 9 Solid Strategies for Wealth Creation and Passive Income

When looking at income inequality in America, the focus is mainly on income as it is unevenly distributed.

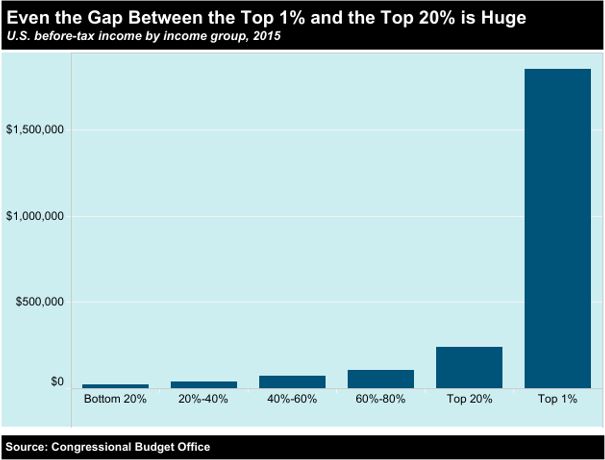

This disparity has become so pronounced that today, 10% of the richest earners in America make 9 times what the bottom 90% make!!

The top 1% bring home 39 times the bottom 10%, meaning the income and wealth gap between even the top earners is substantial.

Today roughly 43.5% of the population in America are considered financially poor or low income.

Income Growth and Income Stagnation Also Plays a Role

Let’s boil it down to the most basic element of this discussion and talk about wages.

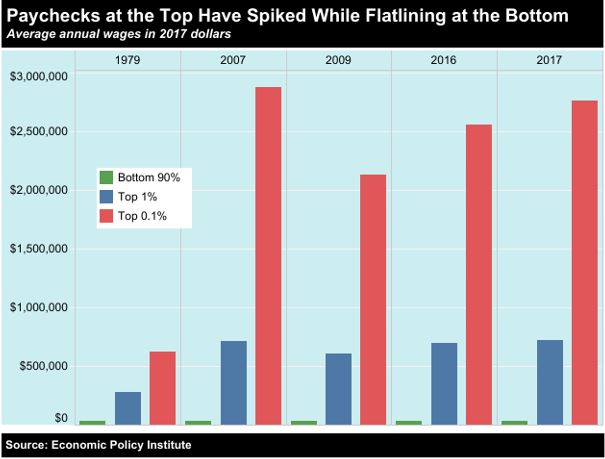

Between 1979 and 2007, the paycheck/wage for the top 1% of American earners skyrocketed.

After the financial crisis of 2008 the wage and salary income for the same groups took a small dive, but it didn’t take long for these earners to regain their pre-crisis income.

And yet, the bottom 90% of workers in America have seen very little change to their average income since 1979.

The bottom 90% of workers in America have seen very little change to their average income since 1979. Share on XBetween 1979 and 2017 the average income has only increased by 22%.

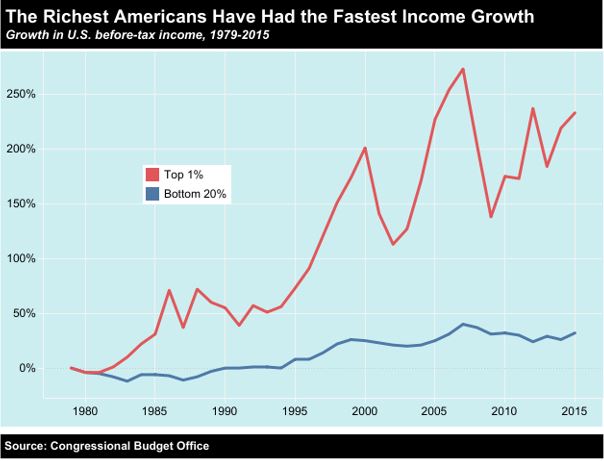

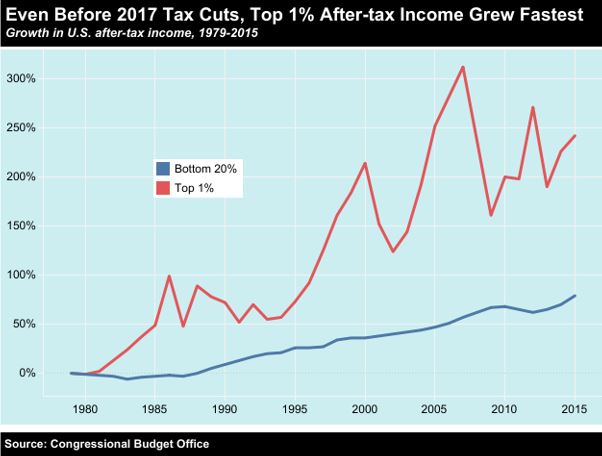

In effect, the richest Americans have seen the fastest level of income growth not just since the crash of 2008 but since the 1980s.

The top 1% of earners have enjoyed substantial gains that, while crashing periodically, have never dipped as low as the bottom 20% of earners.

In fact, the average income has continued to rise annually all while still increasing and decreasing with market fluctuations.

Meanwhile, since the 1980’s, the bottom 20% have not enjoyed significant income growth annually to a degree anywhere close to the top 1%.

The average paychecks for the top earners have spiked while the bottom 90% have seen next to no changes (as indicated by the graph above).

This type of flat-lining has remained in effect since 1979. The discrepancy between the top 1% of American earners and even the top 0.1% is mind blowing.

In the graph below, the bottom 90% is represented by the green bar.

Notice how it has remained virtually the same since 1979.

This is an issue to which there is no easy solution on a societal scale.

Productivity-Wage Discrepancies

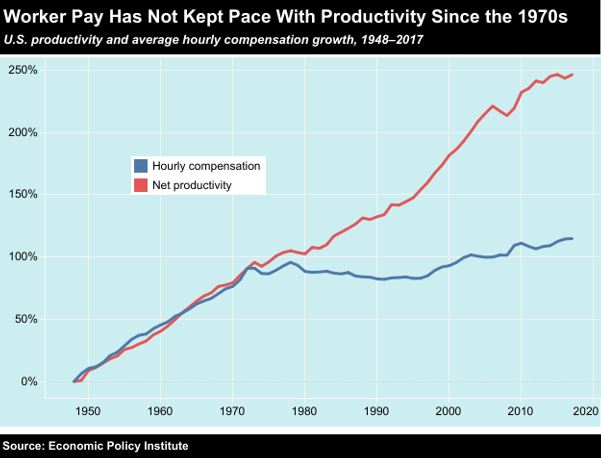

If we go back to 1948, productivity in America has increased at a constant rate. Yet, the wages of American workers contributing to that productivity have not.

Historically, hourly compensation rose in conjunction with productivity requirements, a trend evident between the 1950’s and the 1970’s.

The middle of the 1970’s brought about a drastic halt to this trend, most likely due to advances in technology that allow production to skyrocket with the same workforce.

Workers are still required to keep up with rising productivity demands, while their compensation remains about the same.

This trend has been in effect since the 1970’s, the point where worker hourly compensation began to stagnate.

Since that time compensation has only increased 22%, but by comparison productivity has increased 138%.

If you think about it, this phenomenon widens the income gap even more drastically.

How?

Well, companies are typically owned by those people in the upper income levels.

Imagine it’s 1970 and you own a business. Your company is producing widgets to sell at a profit. Assume also that you have a workforce of 100 people and they can produce 1,000 widgets a day.

Then computers, software, and advanced technology enter the picture. This makes it possible for your team of 100 people to start producing 1,38o widgets a day.

You’re now producing 380 more widgets everyday with same workforce and about the same overhead.

If you make $10 profit per widget… you just made an extra $3,800 per day. That equates to an extra $19,000 per week and $988,000 per year in extra profit.

So the wealth distribution and inequality gap begins to widen between you and your employees.

It’s a difficult problem to solve. Should businesses just increase their pay and take less profit?

I think not.

If you’ve ever read Atlas Shrugged, you’ll know why that is really not a good idea. It’s a work of fiction but it’s become a cult classic for a reason.

Atlas Shrugged may be a work of fiction, but it's become a cult classic for a reason. Share on XUnion Decline is Contributing to Income Disparity

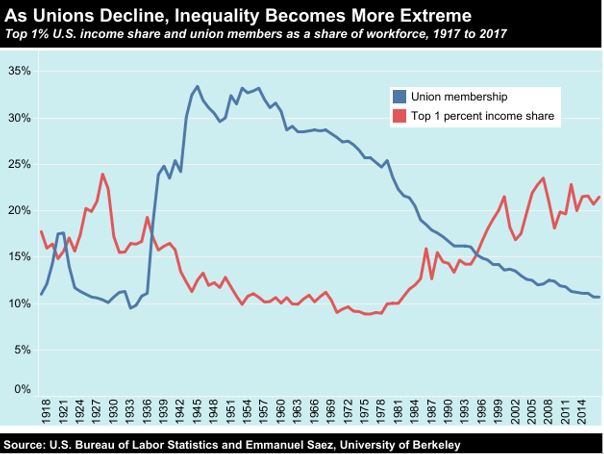

This widening income inequality in America has been further exacerbated by the decline of U.S labor unions.

Labor unions in America have played a critical role in protecting the rights of the workers, making workplaces safe, demanding appropriate raises in accordance with the increased cost of living, and more.

Throughout the tumultuous workplace history of America since the Industrial Revolution, labor unions have ebbed and flowed but today the natural ebbing and flowing is coming to an end.

The percentage of the American workforce represented by a union has significantly declined since the 1940’s and the 50’s.

Individuals at the top of the income scale, as a direct result, have been able to increase their power especially over the economic rules and regulations that guide income and wages.

Some argue that this has produced rules favorable to the wealthy, further increasing American income inequality and subsequently American wealth inequality.

I would argue though that it’s not the rules that are the problem. It’s the difference in mindset.

Capitalists do what they can to protect their capital- That’s why we call them a capitalist.

Capitalists do what they can to protect their capital- That's why we call them a capitalist. Share on XYou can see it starting already. Let’s take a look at some common examples to the outcry for higher wages.

McDonalds: Recently started introducting Kiosks so customers can simply put in their own order. If they need to pay higher wages in the future, they can protect their profits by paying less workers. Replacing them with Kiosks is one way to do that.

Wal-Mart: Another great example. Who needs to pay a worker to scan your items when you can put a camera on the scanner (and above the scanners) and have customers scan their own items?

As a customer, I hate both these things.

Not because I’m on the employees side (I actually think guaranteed wages creates furthers America’s growing entitlement mentality), but because if I’m spending my money in your store, you should be thinking about what’s best for me (the customer).

Guaranteed increases in minimum wages add to the growing entitlement mentality of this country. Share on XPutting me to work when I’m the one frequenting your store is not a way to get me to come back. I try to steer clear of both those companies largely because of this reason.

Maybe I’m suffering from my own sort of customer entitlement issue.

Income Inequality and Gender

Tangentially there exists a significant gender gap in earnings and wages which furthers this divide.

The overwhelming majority of the highest income earners in America are men.

Juxtaposing this is the fact that women represent almost half of the workforce and yet comprise 27% of the top 10% of income earners.

The top 1% of income earners in America is only comprised of 17% females, while the top 0.1% boasts only 11% females.

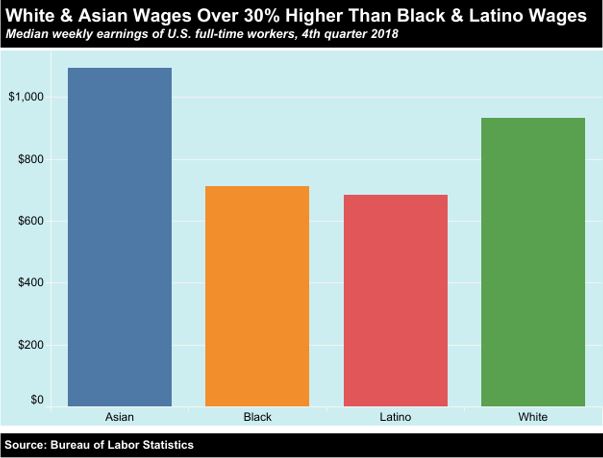

Racial Discrimination in Wages

Racial discrimination contributes to the problem of unequal wealth distribution and wealth inequality in America as discrimination continues to manifest in the form of pay practices, educational opportunities, and hiring practices, all three of which work in tandem against people of color.

For the last quarter of 2018, the average white and Asian worker earned 30% more than their average Latino or black counterparts.

Bonus Inequality

Bonuses for CEOs and other employees present another dilemma in relation to the level of wealth inequality in America.

Bonuses are rarely distributed to the lower-tier of workers in America and yet Wall Street banks are quite well known for the bonuses they award.

In 2017, over 176,000 employees in the state of New York received bonuses that totaled $31.4 billion dollars.

The bonuses allocated to these employees amounts to 2.5 times the combined earnings of every American working full-time at federal minimum wage.

These bonuses are distributed in addition to regular salaries. They effectively allocate even more financial resources to the higher earners in a company.

These additional earnings and bonuses can then be used to generate additional income and subsequent assets that contribute significantly to overall wealth.

It gives these earners more financial options such as saving the money in the form of an interest generating savings account, investing the money in stocks or bonds, or spending the money on the acquisition of other assets and resources such as real estate.

By comparison low-wage workers are living paycheck-to-paycheck spending every single dollar they earn just to meet basic needs.

This lifestyle removes limits their potential for setting aside a savings account, earning interest in the form of an asset, buying a house, or getting out of debt.

Again, this is where it gets difficult.

These high earners are often earning bonuses based on performance.

But it adds to the complex issue of income inequality.

Why would a company NOT reward it’s top producers?

How can you stop the divide from growing without punishing those who are investing wisely and producing in their chosen career path?

Other Articles on Wealth:

– 51 Best Wealth and Prosperity Scriptures for Financial Breakthrough

– 9 Solid Strategies for Wealth Creation and Passive Income Streams

Pay Gaps for CEO’s and Workers

One of the key drivers of income inequality in America is the gap between CEO and worker pay.

This video illustrates the point fairly well and is worth a watch.

Don’t let the cheesy thumbnail fool you into not watching, it’s pretty interesting.

A review of the richest 1% of households in America indicates that 2/3 are made of corporate executives.

Since the 1970’s the gap between worker and CEO income has grown tremendously.

By 2017, the pay gap between CEO’s and workers was 9 times larger than it was in 1980.

Analysis of CEO’s from the S&P 500 firms reveal that CEO’s are paid 361 times the average worker in the United States.

The average CEO pay hovers just shy of 14 million dollars, whereas the average worker pay hovers around $38,000.

The figure has continued to rise as CEO’s in 1990 only earned 42 times the average of American workers.

In 2017 the number jumped by 319 times.

It is public record that U.S. corporations report the ratio or gap between CEO compensation and median worker compensation.

In America, 33 firms have gaps that are larger than 1,000 to 1.

Some of the most highly profitable corporations fall under this list of 33 firms including McDonald’s and Walmart (hmm… maybe they don’t need me to put in my own order or scan my own groceries).

A great deal of this has to do with legislation.

Tax reform is a common solution tossed around by politicians, with an emphasis on tax reforms or tax breaks that end up being more favorable to the wealthy Americans.

Concurrently while Congress is passing favorable tax reform for the wealthiest earners in America, they haven’t passed a federal raise in minimum wage for over 10 years.

Part of the problem is that when certain rules or reforms take place that are not in favor of the wealthy, the wealthy possess power, influence, and income adequate to fight the system.

Unfortunately, the same is not true for the low income earners.

The federal minimum wage for individuals who are categorized as tipped workers, (primarily restaurant servers who receive tips) has remained stagnant since 1991.

That Federal figure stays at $2.13 per hour.

While certain states have passed reforms, there is no comprehensive change set to take place.

In America 24 states have increased that minimum wage but they still retain the two-tier system that includes regular wages and tips.

The way the system works, the federal minimum wage of $7.25 per hour is theoretically required to be met one way or the other.

That means if an employee serving at a restaurant earns $2.13 per hour, and they make an additional $5.12 per hour in tips for that entire hour, they are considered to have met the federal minimum wage and the restaurant employing the individual bears no further responsibility.

However, if the worker does not earn the extra $5.12 each hour in tips, the employers are technically required to make up that difference in wages.

There is really no enforcement for this though.

For 18 states in America, the tipped minimum wage is still at $2.13 per hour.

This is what I made as a server 20 years ago.

Although, the argument could be made that tipped workers make well above minimum wage and there is no need to increase the $2.13 hourly rate.

As the cost of food has increased, so has the wage of a tipped worker because the typical tip is 15-20% of the bill.

While it’s true that make up the difference is not usually enforced, it’s also true that tipped workers don’t always “claim” the true amount they make for tax purposes.

It’s a cash business and often tipped workers downplay how much they made so they don’t get taxed on all of it.

Tax Cuts

The Congressional budget office has revealed that the top 1% of earners bring home a disproportionate amount of income.

Since 1979 (here we go again), the income before taxes for the top 1% has increased 7 times faster compared to the bottom 20% of earners in America.

As tax cuts are implemented in favor of the top earners, this gap is likely to widen even more disproportionately in favor of the wealthy than it is now.

According to the Institute on Taxation and Economic Policy, throughout the course of this year the richest 1% of Americans will receive an additional 27% of the tax cut benefits implemented by Congress.

The same individuals gain a large share of their income from investment profits while everyone else brings home income from wages alone.

This disparity is continuing to contribute significantly to the wealth inequality because wages are linear (you trade 1 hour for x dollars)… Investments are not.

You may invest $1 and earn back $10 or $100. If you keep reinvesting, that money grows disproportionately.

Wages are linear and investments are not. That is one reason why the wealthy get wealthier while the poor seem stuck. Share on XIf you’re in the lower income brackets, you’re at a disadvantage because you have no income to invest.

Even if you do scrounge up some money to invest, you don’t have the experience, knowledge, and wisdom (usually) to make sound financial decisions.

Compare that to a corporate executive who is bringing in over a million a year and making it rain.

If he or she invests in $300,000 house and loses money… they can just learn from their mistakes and try again.

Effects of Wealth Inequality in America

Wealth Concentration

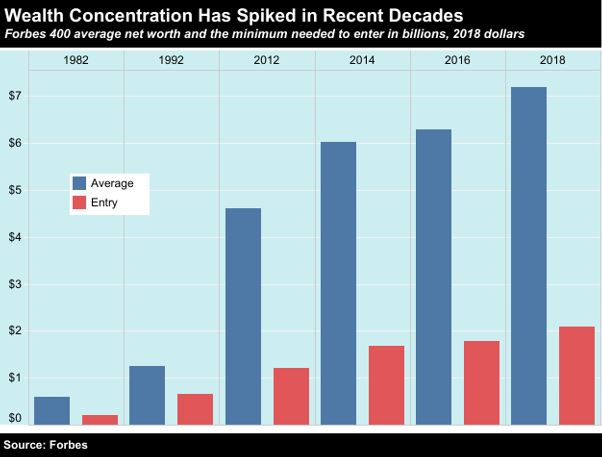

Wealth concentration is another impact of unequal wealth distribution in America.

This level of American wealth inequality reveals the striking differences in income, especially when you consider that the three richest men (from the Forbes list of wealthiest Americans) have combined fortunes that are worth more than the entire wealth of the poorest half of all Americans.

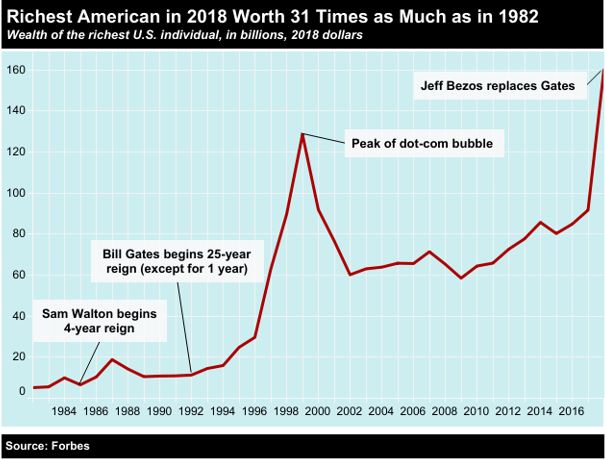

The net worth of the richest person as described by the Forbes richest Americans list went from 5 billion dollars in 1982 to a total of 160 billion dollars in 2018.

As the rich continue to see such startling increases in overall income and wealth, at best the nations poor are seeing incremental gains that still keep them below the poverty line.

Part of this is simply because technology has made it possible to scale larger and faster than anytime in history.

That is why we support people using the most leveraged business model available to help them get some traction in their wealth building journey.

You can do what the richest people do on a smaller scale until you have enough capital to go to the next level.

Household Wealth

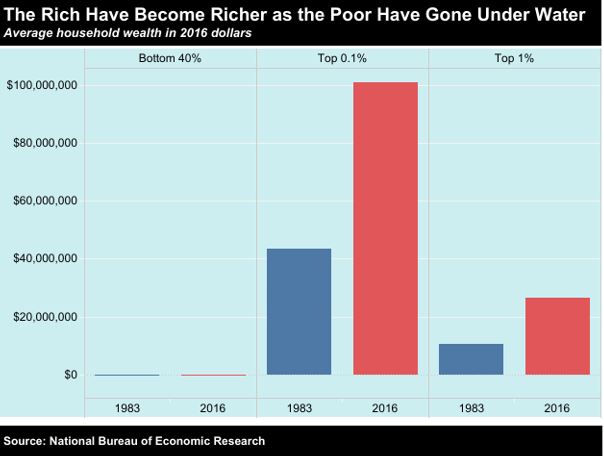

Over the last three decades the most wealthy of Americans have watched their net worth increase while those on the opposite end of the spectrum have debts that far outpace their assets.

The share of wealth in America has always been disproportionately held by the top earners, a trend that came to a head in the 1920’s immediately before the Great Depression.

That figure has made its way back into the American economy, with the richest earners now possessing as large a percentage of wealth in America as they did during the 1920’s.

The wealth that the rich have is not just more than everyone else, it’s not simply a matter of earning more wages or having a higher salary.

They also possess the majority of the asset sources available, which contribute to their wealth and the financial options available to them.

The top percent of Americans own half of the wealth that is invested in mutual funds and stocks.

By comparison, the bottom 90% are responsible for 3/4 of the total debt in America.

The Racial Wealth Divide

Wealth inequality in America contributes heavily to the racial wealth divide as well.

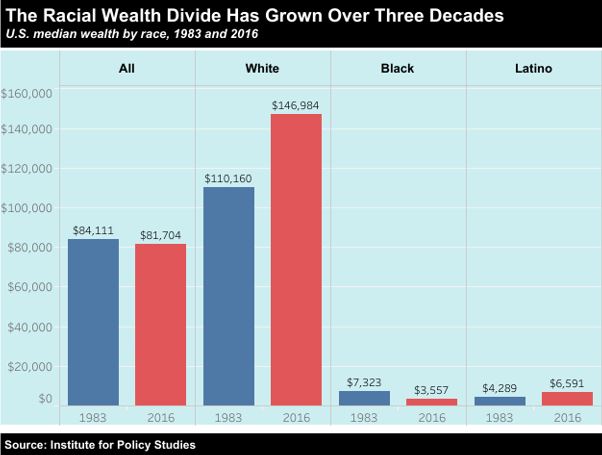

Wealth inequality in America contributes heavily to the racial wealth divide as well. We cannot address one without affecting the other. Share on XExacerbating a national issue, the median wealth of a white family in America hovers around $147,000.

By comparison, the median black family holds just $3,500 while the median Latino family owns just $6,500.

This means that the average white family in America possesses 41 times the wealth of the average black family and 22 times the wealth of the average Latino family.

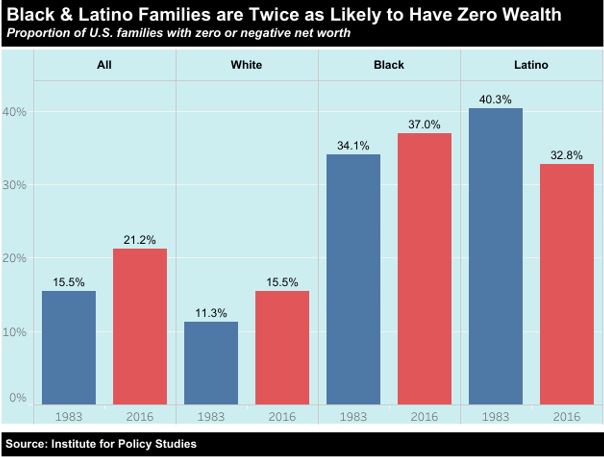

Families with zero wealth or negative wealth, (negative wealth being those whose debts exceed the value of assets), are constantly living a single economic set back away from true poverty and tragedy.

Black families and Latino families in America are more frequently placed in this precarious situation.

Proportionately speaking, the number of black families in America with zero or negative wealth increased from 8.5% back in 1983 to 37% by 2016.

For Latino families that figure increased by 19% over the last 30 years, twice as high as the average rate for white families.

As wealth distribution in America continues to widen the racial gap, basic asset allocation questions arise, which are also subject to a widening racial divide.

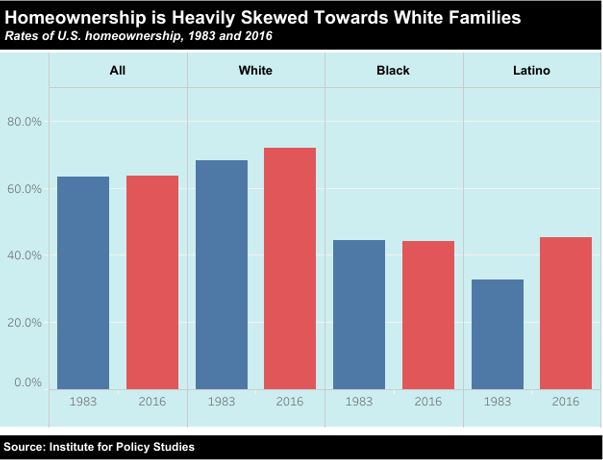

This includes home ownership.

72% of white families in 2016 owned their home but only 44% of black families owned theirs.

Between 1983 and 2016 the number of Latino families who owned their homes increased by 40%, a striking figure and yet one that nonetheless brings the figure to just 45% compared to the 72% of white families.

The End of the Wealth Inequality Tale…

Clearly there are multiple factors at play contributing to an ever-widening gap in income, wealth distribution, and the resulting wealth inequality in America.

So what is the solution?

Given the multiple layered complexity, the solution must tackle each issue individually and simultaneously.

Better financial education and resources for minorities, as well as changes to discrimination in hiring and pay practices will help combat the racial divide, but it won’t fully solve the problem.

We need to roll out financial education to the masses.

You could argue that sound financial education is just a click away if one chooses to educate themselves online.

But not everything online is reliable and if you don’t have a good foundation of knowledge on financial concepts, it’s easy to be fooled by good marketers.

However, changing society through education a huge undertaking. Especially given the fact that the educational system in America is broken.

You would almost have to change the system to actually roll out good solid financial education.

But we have to start somewhere or the financial divide will continue to grow exponentially.

Jim Rohn once said if “Wealth 1” and “Wealth 2” were offered in high school… he would’ve taken both courses!

Should WEALTH 101 and WEALTH 102 be offered as electives in high school? Share on XMaybe that’s where we need to start.

Perhaps we should begin by educating our high school students on how financial systems work and how to build wealth.

My thinking is that when the student is ready, the teacher will appear.

This site is dedicated to help people grow financially and spiritually.

I hope this post gave you something to think about.

Continue to learn and AND IMPLEMENT WHAT YOU LEARN and you’ll eventually be where you want to be financially.

Check out our other articles and please respond in the comments to this question:

Should America try to minimize the distribution of wealth and income? If so, how?

Also, if you found this article helpful, please share on your favorite social media platform.

To start building wealth with us using a proven system, click here.

And as always, we want to remind you that:

If nothing changes… nothing changes!

Lastly, the wealth of the world pales in comparison to spiritual wealth.

If you don’t have a personal relationship with Jesus Christ and would like one, here’s how you can get that going.

Jason & Daniele