Budgeting is a crucial aspect of financial management that enables individuals and businesses to control their finances, plan for the future, and achieve financial stability.

I know, it’s boring and yes… it can be.

But the benefits of budgeting are definitely NOT boring.

Imagine a tool that could get you to your financial freedom faster.

Would you use that tool? Well, the tool is personal or family budgeting.

Whether you’re saving for a major purchase, trying to eliminate debt, or simply aiming to manage expenses more efficiently, a well-structured budget is key to financial success.

Below, we explore the 11 key benefits of budgeting and why everyone should embrace this practice.

1. Helps Manage Finances Effectively

A budget allows individuals to take control of their money.

By tracking income and expenses, a budget ensures that every dollar is accounted for, reducing the chances of overspending and helping people live within their means.

How to Get Started:

- List ALL sources of income.

- Track ALL expenses for a month (Even that $5 latte you get on the way to work every day).

- Categorize spending and set limits.

How do you categorize spending limits?

First, pay your Creator and give a tithe.

10% is standard and Biblical.

Secondly, pay yourself next by deciding on a percentage of your income you are going to save.

I suggest 10% to start for this as well.

From there you can figure out the rest (food, power, water, gas, entertainment, debt servicing/payoff, etc.)

- Adjust spending based on priorities.

2. Encourages Savings and Financial Security

A well-planned budget prioritizes savings, whether for an emergency fund, retirement, or future investments.

Setting aside money regularly can help build financial security, providing a cushion for unexpected expenses such as medical emergencies, car repairs, or job loss.

How to Get Started:

- Open a dedicated savings account.

- Automate monthly savings contributions (this goes back to the first section above but you should make it a percentage and not an amount. That way when your income goes up, so does your savings).

- Set short-term and long-term savings goals.

- Reduce unnecessary expenses to boost savings.

3. Reduces Stress and Financial Anxiety

Financial uncertainty is a common source of stress for many people.

Having a budget in place helps alleviate anxiety by offering a clear plan for managing expenses, paying bills on time, and setting aside funds for future needs.

This sense of control can lead to improved mental well-being.

How to Get Started:

- Create a detailed monthly budget.

- Set up reminders for bill payments.

- Establish a buffer for unexpected expenses. (This should be baked into your plan, not a constant draining of your savings account)

- Regularly review and adjust your budget.

4. Aids in Debt Management

For those struggling with debt, budgeting is an essential tool for paying off loans efficiently.

By allocating a specific portion of income toward debt repayment, you can reduce your liabilities faster and avoid costly interest payments.

Budgeting also helps prevent accumulating unnecessary debt by promoting mindful spending.

How to Get Started:

- List all outstanding debts and their interest rates.

- Prioritize high-interest debts first.

- Allocate a fixed amount each month toward repayment.

- Avoid taking on new debt unnecessarily.

- As you pay debts off, snowball that payment into the next high priority payment to increase the speed and effect- This is commonly referred to as a debt snowball)

5. Facilitates Goal Achievement

Whether it’s buying a home, starting a business, or going on a dream vacation, budgeting helps set and achieve financial goals.

By creating a financial roadmap, individuals can allocate funds strategically, ensuring steady progress toward their aspirations.

How to Get Started:

- Identify short-term and long-term financial goals.

- Break goals into smaller, manageable steps.

- Set up a dedicated savings plan for each goal.

- Track progress regularly and adjust as needed.

6. Improves Spending Habits

A budget helps identify spending patterns and areas where money may be wasted.

By analyzing expenses, individuals can make informed decisions, cut back on unnecessary purchases, and reallocate funds toward more meaningful financial priorities.

How to Get Started:

- Review past spending habits.

- Identify areas where you can cut costs.

- Use cash or a prepaid card for discretionary spending.

- Set a limit for non-essential purchases.

*This may not be fun but it’s like losing weight. When you don’t eat the doughnut, you know you’re making progress.

Same concept here but it’s applied to your personal finances.

When you don’t buy the latest, greatest gadget or go out on the town (or whatever you choose to blow your money on), then you are making progress.

7. Prepares for Emergencies

Life is unpredictable, and financial emergencies can arise at any time.

A budget that includes an emergency fund ensures that individuals are prepared for unexpected situations without relying on credit cards or loans, which can lead to financial strain.

How to Get Started:

- Determine a target emergency fund amount.

- Save at least three to six months’ worth of expenses.

- Keep emergency funds in a separate, accessible account.

- Replenish funds after use.

*If you’re saving 10% of your income, your emergency fund is going to grow naturally.

The key is to not touch it unless it’s a true emergency.

8. Enhances Financial Independence

Budgeting fosters financial independence by promoting self-sufficiency.

When you have a clear understanding of your income, expenses, and financial goals, you become less reliant on external financial support and can make informed decisions about your financial future.

How to Get Started:

- Track all income and expenses carefully.

- Develop multiple income streams.

- Learn about investing and wealth-building strategies.

- Make informed financial decisions based on goals.

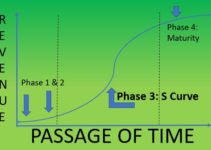

9. Encourages Smart Investments

Budgeting allows individuals to allocate funds toward investments, helping to build wealth over time.

Investing wisely can lead to financial growth and stability.

How to Get Started:

- Learn about different investment options.

- Set aside a portion of your budget for investing.

- Diversify investments to minimize risk.

- Consult a financial advisor for guidance.

*This is where your savings account comes back into play if you already have an emergency fund built up.

If you really want to accelerate things, you can also do an investment account that is seperate from your savings account but I don’t recommend doing that until you have paid off all your debt.

After paying off debt, the debt snowball you used can be re-allocated into the investment snowball.

At that point it works backwards.

All the debt snowball money goes into an account.

When you have enough for an investment you send the money out and when that money flows back in (hopefully as more than you sent out) you put it all back into the investment account.

Over time, this account can grow substantially and quickly and even dwarf your savings account.

It is this investment account that can bring you true financial freedom.

10. Promotes Family Financial Planning

A budget benefits not just individuals but entire families.

It ensures that household finances are managed responsibly and that everyone is aligned toward common financial goals.

How to Get Started:

- Involve family members in financial discussions.

- Set joint financial goals.

- Create a family budget and assign responsibilities.

- Plan for future expenses such as education and retirement.

11. Boosts Confidence in Financial Decisions

Having a clear budget in place provides the confidence to make informed financial decisions without second-guessing or fear of financial instability.

How to Get Started:

- Educate yourself on financial literacy.

- Use budgeting apps or tools for tracking.

- Review and refine your budget periodically.

- Seek professional financial advice when needed.

Conclusion

Budgeting is an essential practice that offers numerous benefits, from better money management to reducing stress and achieving financial goals.

By creating and sticking to a budget, you can improve your financial well-being, gain greater control over your money, and work toward long-term financial success.

No matter your income level, implementing a budget can help secure a more stable and prosperous future.

Other Interesting Articles:

What is a Roth IRA – Why do YOU need one?

How to Make Passive Income Online

How to Double the Money in your Investment Account

If you’d like a personal relationship with Jesus Christ, visit our salvation page.

God Bless,

Jason and Daniele